- What Is Accounts Payable Automation (AP Automation)?

- How to automate accounts payable?: Step-by-step

- The Real Problem with Manual Accounts Payable

- What can you automate in the AP process?

- Top Accounts Payable Tasks to Automate

- What are the benefits of AP Automation for your business?

- Department-Level Impact of AP Automation

- Digital Payment Options & Virtual Cards

- How AP Automation Supports Business Continuity?

- What is the ROI of AP Automation?

- What are the best practices for a smooth transition?

- Choosing the Right AP Automation Software

- When Do You Need a Custom AP Automation System?

- Accounts Payable Automation Case Study: AP Automation

- Conclusion

- Frequently Asked Questions (FAQs)

Table of Contents

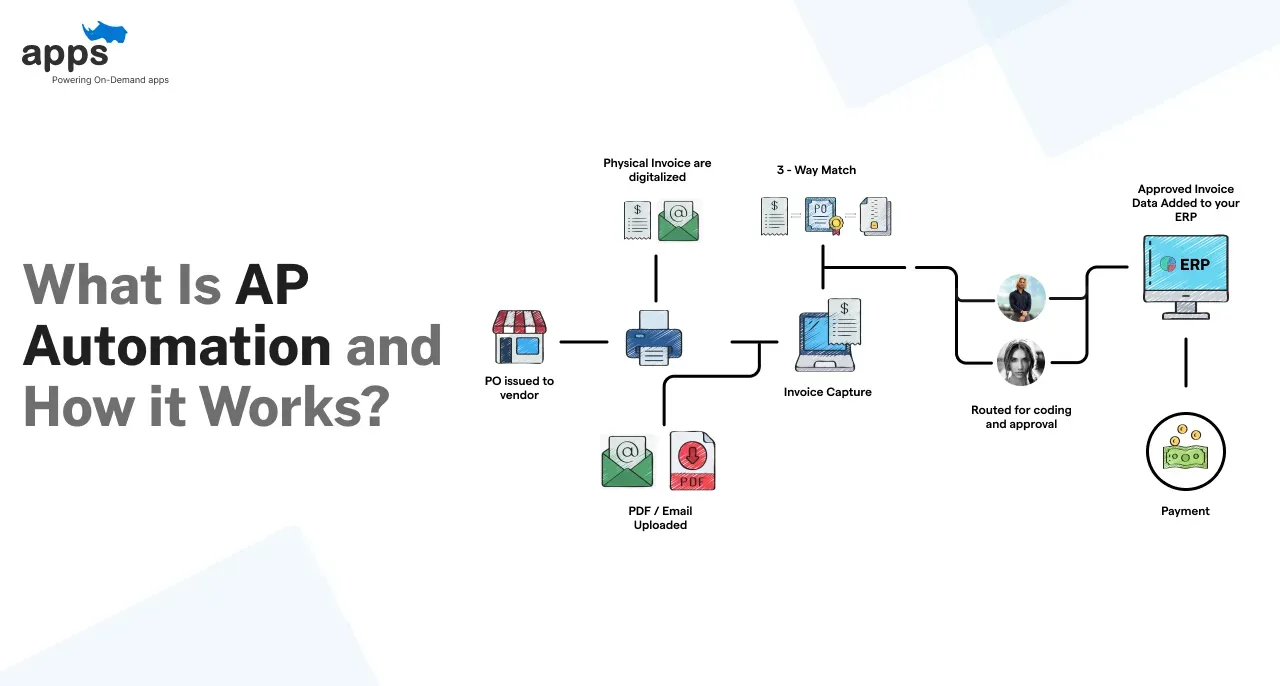

What Is AP Automation and How it Works?

If your team is drowning in vendor invoices, approvals, and payment follow-ups, you’re not alone. Most growing businesses still rely on outdated accounts payable (AP) processes that involve emails, spreadsheets, or even printed invoices.

These manual tasks don’t just waste time they silently drain your resources, delay payments, and create a perfect storm for errors.

This is where AP automation steps in. Simply put, it digitizes and streamlines your accounts payable workflow automation from invoice capture to payment, saving time, money, and sanity.

Whether you’re a scaling eCommerce brand, logistics operator, or a multi-location enterprise, automating accounts payable is no longer a nice-to-have; it’s a must.

In this blog, you’ll learn:

- What accounts payable automation really means (in plain English)

- Why manual AP processes hold your business back

- How automation works step-by-step

- What tasks can be automated (and what still needs human review)

- The financial, operational, and strategic benefits

- When to choose off-the-shelf vs. custom solutions

- And real-world examples from businesses like yours

If you’re ready to take the guesswork out of payments, reduce human error, and scale faster, this guide is your starting point.

What Is Accounts Payable Automation (AP Automation)?

Automated accounts payable is the process of using software to manage and streamline invoice receipt, approval, and payment without endless paperwork or manual entry.

Instead of pushing invoices through email chains and spreadsheets, AP automation digitizes each step so you can process payments faster and more accurately.

At its core, AP automation replaces:

- Manual invoice sorting and data entry

- Approval emails or physical signatures

- Spreadsheet-based tracking

- Payment errors due to missed deadlines or miscommunication

With automation, invoices are captured digitally (via email, uploads, or scans), data is extracted using OCR and AI, routed automatically for approval, and paid electronically all while maintaining an audit trail.

Many small businesses assume AP automation is only for enterprises.

That’s a misconception. Modern platforms offer flexible solutions suitable for businesses of all sizes, including startups with lean finance teams.

Whether you're processing 100 or 10,000 invoices per month, automation helps reduce delays, errors, and operational costs.

AP automation is a foundational part of broader financial automation, which includes expense management, procurement, and cash flow forecasting.

When integrated with your ERP or accounting tools, it gives finance leaders real-time visibility into outstanding liabilities, pending approvals, and upcoming payments.

In other words, it turns your accounts payable process into a streamlined, trackable, and predictable workflow.

If your business is growing and your AP team is struggling to keep up, now is the time to shift from spreadsheets to smart systems and unlock the full value of accounts payable automation.

How to automate accounts payable?: Step-by-step

Understanding how AP automation works can make all the difference when deciding whether it's the right time to upgrade your process.

Here's a breakdown of the key steps involved:

Step 1

Invoice Capture

Invoices can be received via email, scan, upload, or direct vendor portal entry. Instead of your AP team manually collecting them, the system centralizes them in one inbox.

Step 2

Data Extraction

Using AI and OCR (optical character recognition), the system pulls key details vendor name, invoice number, date, amount, line items and inputs them into your ERP or finance system.

Step 3

Validation

Each invoice is validated against purchase orders, delivery receipts, and GL codes to ensure accuracy. This three-way match prevents overpayments and fraud.

Step 4

Approval Routing

Based on pre-set rules (by department, amount, or vendor), the system routes invoices to the right approvers. You can set up sequential or parallel workflows.

Step 5

Payment Scheduling

Once approved, invoices are queued for payment on the optimal date either to capture early payment discounts or just before the due date to preserve cash.

Step 6

Real-Time Status Tracking

Each invoice has a digital trail showing where it is in the process: captured, validated, approved, scheduled, or paid. No more guessing or chasing email threads.

Step 7

Audit and History Logs

Every action is time-stamped, providing a complete audit trail for compliance and internal reviews.

Step 8

Remote Access for Hybrid Teams

Because most AP automation systems are cloud-based, finance teams can access, approve, and manage invoices from anywhere ideal for hybrid or remote setups.

Example: REVOLVE, a leading eCommerce brand, reduced invoice processing time by 80% using AP automation cutting approval cycles from 5 days to just 1.

In short, accounts payable automation replaces disjointed, manual steps with a fluid, accurate, and trackable workflow, freeing your team to focus on more strategic work.

The Real Problem with Manual Accounts Payable

Manual AP processes might feel manageable at first. But as your business scales, what once took minutes turns into hours of repetitive, error-prone work.

Here’s what many business owners are battling every month:

- Invoice chaos: Paper invoices and PDFs via email pile up fast. Sorting, printing, and forwarding them adds layers of complexity.

- Average Cost per Invoice: Manual processing costs range from $12 to $30 per invoice, depending on the complexity and industry.

- Processing Time: Manual invoice processing can take up to 16.3 days on average.

- Error Rates: Approximately 1–2% of manually processed invoices contain errors, leading to additional costs for corrections.

- Labor Costs: Labor accounts for 90% of the total cost in manual invoice processing.

- Manual data entry: Your AP team must retype invoice details into accounting software. Typos, miskeyed amounts, and skipped fields are common and costly.

- Approval bottlenecks: Invoices sit in inboxes waiting for approvals, especially when team members are remote or tied up. This delays payments and damages vendor trust.

- Missed discounts and late fees: Early payment discounts often go unused, while missed due dates result in penalty fees.

- Lack of visibility and audit trail: Who approved what and when? Manual processes leave gaps that create risks during audits.

The bigger issue? Manual AP isn’t just inefficient it’s a growth bottleneck.

- Hidden costs: A study by the Institute of Finance and Management (IOFM) shows that manually processing a single invoice can cost up to $15, compared to $2 or less with automation.

- Scaling issues: As invoice volume increases, your AP team can’t keep up without hiring more staff.

- Cash flow blind spots: Without real-time visibility, it’s hard to forecast liabilities or optimize spend.

- Vendor frustration: Late or missed payments strain relationships and can lead to service interruptions.

In short, the longer you rely on manual accounts payable, the more risk, cost, and friction you add to your operations. The solution? A scalable, intelligent system that turns chaos into control. Enter: accounts payable automation.

What can you automate in the AP process?

Modern AP automation doesn’t just handle invoices; it covers the entire accounts payable workflow from intake to archiving.

Here’s a breakdown of what you can automate today:

Top Accounts Payable Tasks to Automate

Invoice Intake and Data Capture

From emailed PDFs to scanned paper invoices, automation tools capture and store invoice data instantly, reducing manual uploads and eliminating lost documents.

Three-Way Matching

Automatically match invoices with purchase orders and goods received notes. This ensures only approved, fulfilled orders get paid without human verification.

Approval Routing

Set rules for routing invoices to the right decision-makers based on vendor, department, amount, or project. Escalations and reminders keep things moving.

Payments

Schedule payments through ACH, wire transfers, or virtual cards. Automate early payment discount logic or hold payments until due.

Vendor Communication

Send auto-alerts for missing info, rejected invoices, or status updates. Vendors stay informed without constant email follow-ups from your team.

Document Archiving

Invoices, approvals, and payment receipts are stored digitally, searchable by vendor, date, or invoice number. Perfect for audits or year-end reconciliation.

Alerts and Escalations

Missed deadlines or stalled approvals? Automation tools trigger alerts and escalate unresolved items so invoices never fall through the cracks.

Example: Gate Gourmet, a global airline catering provider, automated vendor communications and approval workflows, achieving a 30% increase in overall efficiency and eliminating approval bottlenecks. (Source: Datamatics)

By automating these repetitive and time-consuming tasks, your team gains back time, improves accuracy, and builds a more resilient AP operation.

With the right system, the accounts payable automation process can be as hands-off or rule-driven as you need it to be.

What are the benefits of AP Automation for your business?

Investing in AP automation is about more than just speed it transforms your financial operations from reactive to strategic.

Here are the biggest AP automation benefits:

Time and Cost Savings

Automated systems significantly reduce invoice processing time.

According to Levvel Research, companies using AP automation process invoices 74% faster and cut costs by up to 80% compared to manual methods.

Eliminate Manual Errors

Human error in data entry or approvals can cause major issues duplicate payments, wrong amounts, missed invoices.

Automation removes these risks by validating data and applying consistent rules.

Avoid Late Payments

Timely payments mean better cash flow and stronger vendor relationships.

Automation ensures no invoice gets lost or forgotten, and payment scheduling prevents last-minute scrambles.

Easier Audits and Compliance

Every step, capture, approval, and payment is logged with timestamps and user actions.

This simplifies internal audits, financial reporting, and regulatory compliance (especially for SOC 2 or SOX).

Early Payment Discounts

By speeding up invoice approval, you can pay vendors early and take advantage of early payment discounts, turning AP into a savings center rather than just a cost center.

Better Vendor Satisfaction

Vendors love consistency. With automated updates, on-time payments, and less back-and-forth, vendors are more likely to prioritize your business and offer better terms.

Scalability

As your business grows, you won’t need to add headcount to keep up with AP volume. Automation adapts to growth effortlessly across locations, currencies, and payment types.

From finance leaders to operations managers, everyone benefits when AP runs smoothly.

Whether you're after tighter cash control or stronger vendor relationships, accounts payable automation delivers lasting operational efficiency.

Department-Level Impact of AP Automation

Implementing accounts payable automation benefits your finance team it positively impacts multiple departments across your organization.

Here’s how different stakeholders feel the impact:

For CFOs

Real-time insights into liabilities and spending patterns improve financial forecasting.

You gain control over cash flow, reduce unexpected expenses, and improve working capital management.

For Controllers

No more chasing paper trails or sifting through spreadsheets.

Automated logs, consistent data entry, and visibility across all invoices streamline reconciliation, month-end close, and audit readiness.

For AP Teams

Automation eliminates repetitive tasks like invoice entry, approval nudges, and manual uploads.

Teams gain back time and reduce stress by focusing on exception handling and vendor communication instead.

For IT

Modern AP automation tools are built for easy integration. With fewer internal support tickets and API-based connectivity with existing ERPs, IT teams can focus on higher-priority tech initiatives.

Example: Tuff Shed's 17-person accounting team implemented AP automation, significantly reducing administrative burdens, enhancing productivity, and eliminating the need for additional hires.

From better reporting for finance to fewer bottlenecks in operations and less overhead on IT, automation delivers cross-functional improvements that scale with your business.

When the AP process improves, so performs everyone connected to it.

Digital Payment Options & Virtual Cards

Automating AP isn’t just about invoices it also changes how your business handles payments.

A good accounts payable automation system supports a variety of digital payment methods to streamline transactions.

ACH, Wire Transfers, and Checks

Automated platforms handle traditional payment types, including ACH (bank transfers), wire transfers, and even printed checks.

These are scheduled automatically based on approval workflows or payment timing rules.

Virtual Cards

Virtual cards are one-time-use, secure credit card numbers used for vendor payments.

They reduce fraud risk, offer better control, and generate cash rebates from your card provider.

Why Virtual Cards Matter

Unlike static card numbers, virtual cards are tied to a specific transaction and vendor, making them harder to misuse.

You can set spend limits, expiration dates, and payment caps ideal for recurring or one-off purchases.

Fraud Protection and Control

The Association for Financial Professionals reports that virtual cards significantly reduce the risk of payment fraud.

You also gain granular control over who spends what and when.

Example: Quartzy, a life sciences company, adopted virtual card payments through MineralTree's SilverPay, projecting $100,000 in annual rebates, effectively offsetting the platform's cost.

With digital payments and virtual cards built into your AP process, you reduce manual work, gain better security, and optimize your cash flow.

AP automation doesn’t just make payments faster, it makes them smarter.

How AP Automation Supports Business Continuity?

In today’s unpredictable world, business continuity is non-negotiable. Whether it's a global disruption or a local outage, your AP process shouldn't come to a halt. That’s where AP automation plays a crucial role.

Cloud-based AP automation tools ensure uninterrupted operations your team can capture, approve, and pay invoices from anywhere with an internet connection.

There’s no dependence on physical office spaces, filing cabinets, or in-person approvals.

For remote or hybrid teams, this means seamless collaboration and decision-making. Invoices don’t sit in someone’s inbox or get lost in a shuffle they’re accessible, trackable, and actionable in real time.

In the event of disruptions, such as natural disasters or sudden staff changes, accounts payable automation ensures your payment obligations are still met on time avoiding late fees and preserving vendor trust.

Example: During the COVID-19 pandemic, a company implemented AP automation and achieved a 60% reduction in data entry, 75% savings on paper costs, and 92% reduction in printing expenses, ensuring uninterrupted operations amid office closures.

By removing location and paper-based limitations, AP automation becomes a safeguard not just a convenience. It ensures continuity, resilience, and confidence in your financial operations no matter what comes next.

What is the ROI of AP Automation?

The return on investment (ROI) for AP automation is both immediate and measurable.

Manual invoice processing typically costs between $10 to $15 per invoice, according to the Institute of Finance and Management (IOFM).

Automated invoice processing can reduce costs to as low as $3.34 per invoice or lower.

Time savings are just as impactful. Businesses report reducing invoice cycle times by up to 80%, which means fewer delays, better cash flow management, and fewer late payment penalties.

Add in the potential to capture early payment discounts, and AP automation quickly pays for itself.

Error reduction also saves money. Duplicate payments, incorrect amounts, and fraud risks drop significantly with rule-based workflows and audit trails.

Beyond dollars, ROI also comes in the form of improved vendor relationships, better internal morale, and more accurate financial forecasting.

In short, accounts payable automation isn’t just a cost-cutting move it’s a strategic upgrade that frees your team to focus on value-added work while keeping your finances airtight.

What are the best practices for a smooth transition?

Transitioning to accounts payable automation doesn’t have to be overwhelming.

With the right approach, your team can adopt new tools with minimal disruption and maximum results.

Don’t rush implementation

A phased rollout allows teams to learn and adapt.

Start with invoice capture and approval, then expand to payments and vendor communication.

Involve the right teams early

Loop in finance, IT, procurement, and operations from the start. Their feedback will help you select the right platform and avoid surprises later.

Set up clear workflows

Define invoice approval chains, payment timelines, and exception handling before going live.

This reduces confusion and keeps your AP process running smoothly.

Keep vendors in the loop

Notify vendors about the new process.

Let them know how to submit invoices, what formats are accepted, and where they can track payment status.

Start small, then scale

Test automation with a subset of vendors or locations first. Once successful, apply those lessons to broader implementation.

By following these best practices, you’ll boost adoption, avoid avoidable rework, and ensure your AP automation journey delivers on its promise of speed, accuracy, and control.

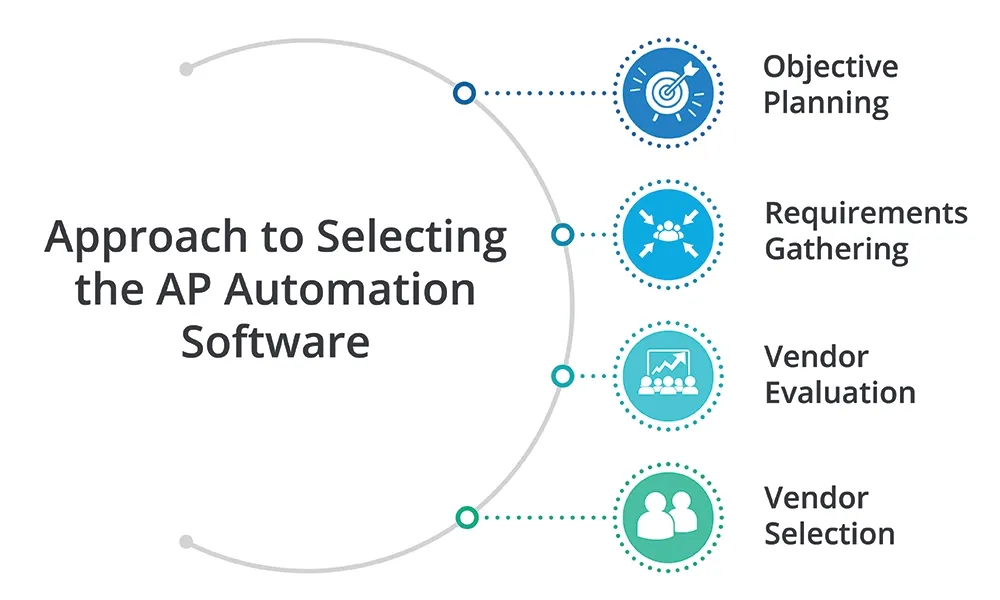

Choosing the Right AP Automation Software

Choosing the best accounts payable automation software is critical to long-term success.

With dozens of tools on the market, here's what to prioritize:

Easy Integration with ERP/Accounting Tools

Ensure the software integrates seamlessly with platforms like QuickBooks, NetSuite, Xer, or SAP. Smooth integration reduces disruption and speeds up adoption.

Custom Workflows

Look for software that allows rule-based routing for approvals, exceptions, and multi-location or multi-entity workflows tailored to your process.

Real-Time Dashboards

Dashboards that show invoice status, cash flow projections, and payment history help your team make faster, informed decisions.

Security and Compliance

Check for SOC 2, GDPR, HIPAA, or SOX compliance depending on your industry. Features like user roles, 2FA, and audit trails are must-haves.

Vendor Support Tools

Choose a system with vendor portals or communication tools to reduce back-and-forth emails and keep vendors informed in real time.

Mobile Accessibility

Remote approvals matter especially for distributed or hybrid teams. Ensure the tool works well on mobile and offers alerts and review options on the go.

The best accounts payable automation platform isn’t just feature-rich it’s the one that fits your workflows, scales with your team, and keeps financial data secure.

When Do You Need a Custom AP Automation System?

Sometimes off-the-shelf AP tools aren’t enough. If your accounts payable process involves unique workflows, strict compliance requirements, or deeply integrated systems, it may be time to explore a custom-built AP automation solution.

When to Consider Custom Development:

- Your industry has strict documentation or audit standards (e.g., construction, healthcare, or government contracts).

- You operate across multiple entities or currencies with unique approval rules.

- Your existing tech stack involves legacy ERP systems with limited integration support.

- You need tailored dashboards, role-based visibility, or multi-layered approval flows.

A custom accounts payable automation solutions ensures every feature fits your workflow no compromises.

You can build in controls for risk management, tax compliance, or procurement alignment based on how your business runs.

Steps to Building a Custom System

- Define Your Requirements – Map your pain points, user roles, and workflow gaps. Prioritize what you want to automate.

- Choose the Right Partner – Work with a software development team familiar with finance automation and compliance.

- Plan for Scale and Security – Ensure the system is future-ready, secure (SOC 2/GDPR), and able to support future integrations.

Example: A healthcare organization built a custom AP system that routed invoices by department, linked to patient billing, and flagged non-compliant vendors.

It cut processing time in half and passed audits with zero findings.

Custom AP automation isn’t for every business but for those with complex needs, it can unlock unmatched precision, control, and compliance.

Accounts Payable Automation Case Study: AP Automation

Discover how leading organizations have leveraged accounts payable automation to enhance efficiency, reduce costs, and streamline operations.

REVA Air Ambulance: Accelerating AP Processing

- Industry: Air Medical Transportation

- Challenge: Manual invoice processing led to delays in approvals and month-end reconciliations.

- Solution: Implemented Ramp's AP automation platform.

- Results

- Reduced invoice processing time by over 80%.

- Streamlined approvals and improved real-time financial visibility.

- Source: Ramp BlogRamp

Global Telecommunications Provider: Enhancing Efficiency with RPA

- Industry: Telecommunications

- Challenge: Manual handling of over 1,000 daily invoices caused processing delays and late payment penalties.

- Solution: Adopted Tungsten's RPA and digital mailroom solutions.

- Results:

- Achieved up to 400% increase in productivity.

- Significantly reduced late payment penalties and improved service continuity.

- Source: Tungsten Automation

These examples underscore the tangible benefits of AP automation in diverse sectors, highlighting improvements in efficiency, accuracy, and financial control.

Conclusion

Manual AP processes were never designed for today’s pace of business. They create bottlenecks, increase risk, and make scaling harder than it needs to be.

As you’ve seen throughout this guide, accounts payable automation helps modern businesses move faster, operate leaner, and improve vendor relationships with fewer headaches.

From reduced processing costs and better audit control to stronger team collaboration and real-time visibility, AP automation isn’t just about saving time. It’s about empowering your finance operations to drive growth, not just support it.

If your business is growing and your AP team is struggling to keep up, now is the time to act.

Here’s what you can do next

- Audit your current AP process: what’s manual, what’s slow, what breaks?

- Explore software options aligned with your systems and goals

- Loop in finance, ops, and IT to evaluate needs and integration

Whether you choose an off-the-shelf solution or build a custom system, the benefits are too great to ignore. Start small, measure results, and scale with confidence. Your bottom line and your team will thank you.

Frequently Asked Questions (FAQs)

What does AP automation mean?

AP automation refers to using software to manage invoice receipt, approval, and payment, eliminating manual entry, delays, and errors in accounts payable.

What features to look for in accounts payable automation tools?

Key features include invoice scanning, OCR, approval workflows, payment scheduling, fraud detection, ERP integration, and real-time analytics for smooth and accurate financial processing.

How automation improves accounts payable efficiency?

Automation enhances efficiency by reducing manual data entry, minimizing errors, speeding up approvals, improving visibility, and enabling faster, more accurate vendor payments.

How can government agencies automate accounts payable?

Government agencies can automate accounts payable by adopting secure cloud-based platforms with invoice digitization, compliance checks, and audit trails, improving transparency and reducing administrative costs.

How do I choose the best accounts payable automation solution?

Choose based on integration capabilities, scalability, security compliance, ease of use, and ROI, ensuring it aligns with your accounting system and business workflows.

Which fintech company excels in accounts payable automation?

Top fintech companies excelling in accounts payable automation include Tipalti, Stampli, AvidXchange, and MineralTree, known for smart invoice processing and end-to-end payment automation.

What is the AP tool used for?

An Accounts Payable (AP) tool helps businesses manage, streamline, and automate invoice processing, approvals, and payments, improving cash flow visibility and reducing manual data entry errors.

How much does AP automation cost?

AP automation typically costs $8,000 to $15,000 annually for small businesses, $15,000 to $35,000 for mid-sized firms, and $35,000 to $100,000+ for large enterprises, depending on invoice volume and features.

What is AP software?

AP software automates the accounts payable process, handling tasks like invoice receipt, matching, approvals, and vendor payments. It enhances accuracy, compliance, and financial efficiency for organizations of all sizes.

Table of Contents

- What Is Accounts Payable Automation (AP Automation)?

- How to automate accounts payable?: Step-by-step

- The Real Problem with Manual Accounts Payable

- What can you automate in the AP process?

- Top Accounts Payable Tasks to Automate

- What are the benefits of AP Automation for your business?

- Department-Level Impact of AP Automation

- Digital Payment Options & Virtual Cards

- How AP Automation Supports Business Continuity?

- What is the ROI of AP Automation?

- What are the best practices for a smooth transition?

- Choosing the Right AP Automation Software

- When Do You Need a Custom AP Automation System?

- Accounts Payable Automation Case Study: AP Automation

- Conclusion

- Frequently Asked Questions (FAQs)