- What is Joget?

- Joget’s Low-Code Platform and Its Capabilities

- Why Joget is Suitable for the Insurance Industry?

- Case Studies: How Industry Leaders Use Joget

- Key Benefits of Using Joget in Insurance

- Conclusion

- Frequently Asked Questions (FAQs)

Table of Contents

How Leading Industry Players are Shaping the Insurance World with Joget

The insurance industry is evolving fast, driven by new technologies and the need for greater efficiency. Joget, a no-code/low-code application platform, is becoming a game-changer for many leading players.

With its ability to streamline processes, enhance customer service, and ensure compliance, Joget is helping insurers stay competitive.

In this Joget Tutorial, you’ll explore how top industry players use Joget to transform their operations, improve customer experiences, and meet the challenges of a rapidly changing market.

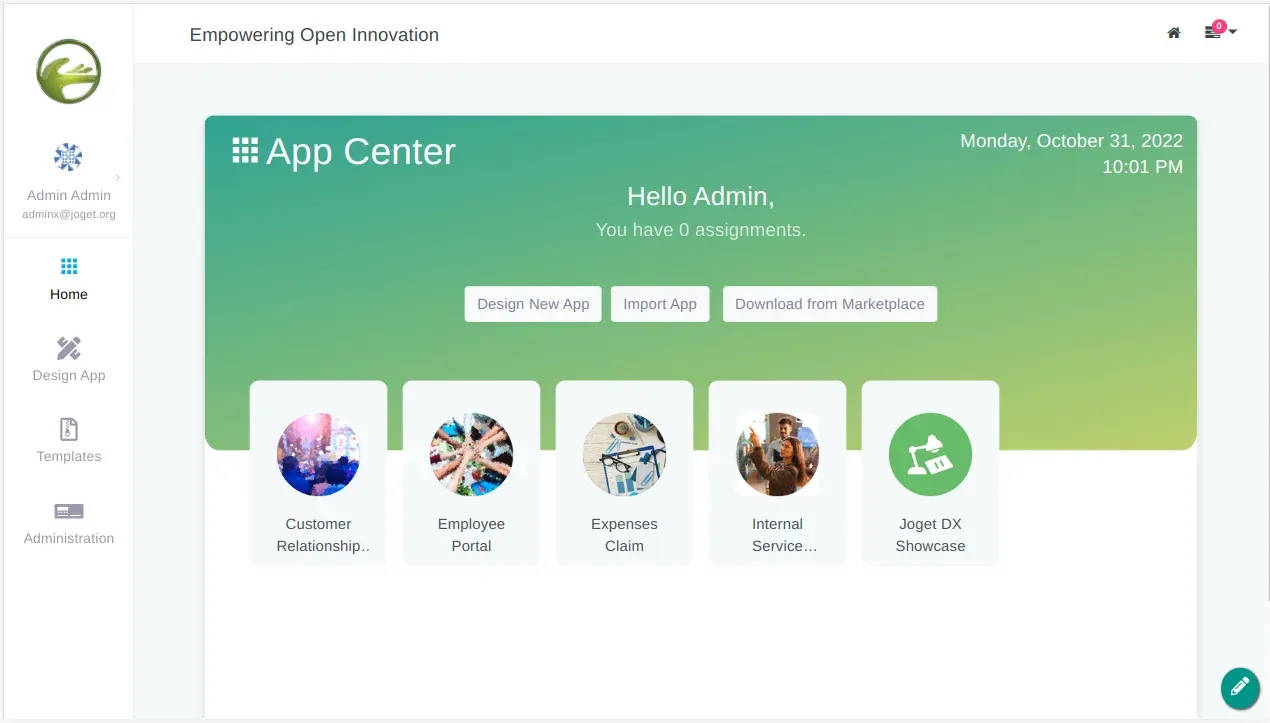

What is Joget?

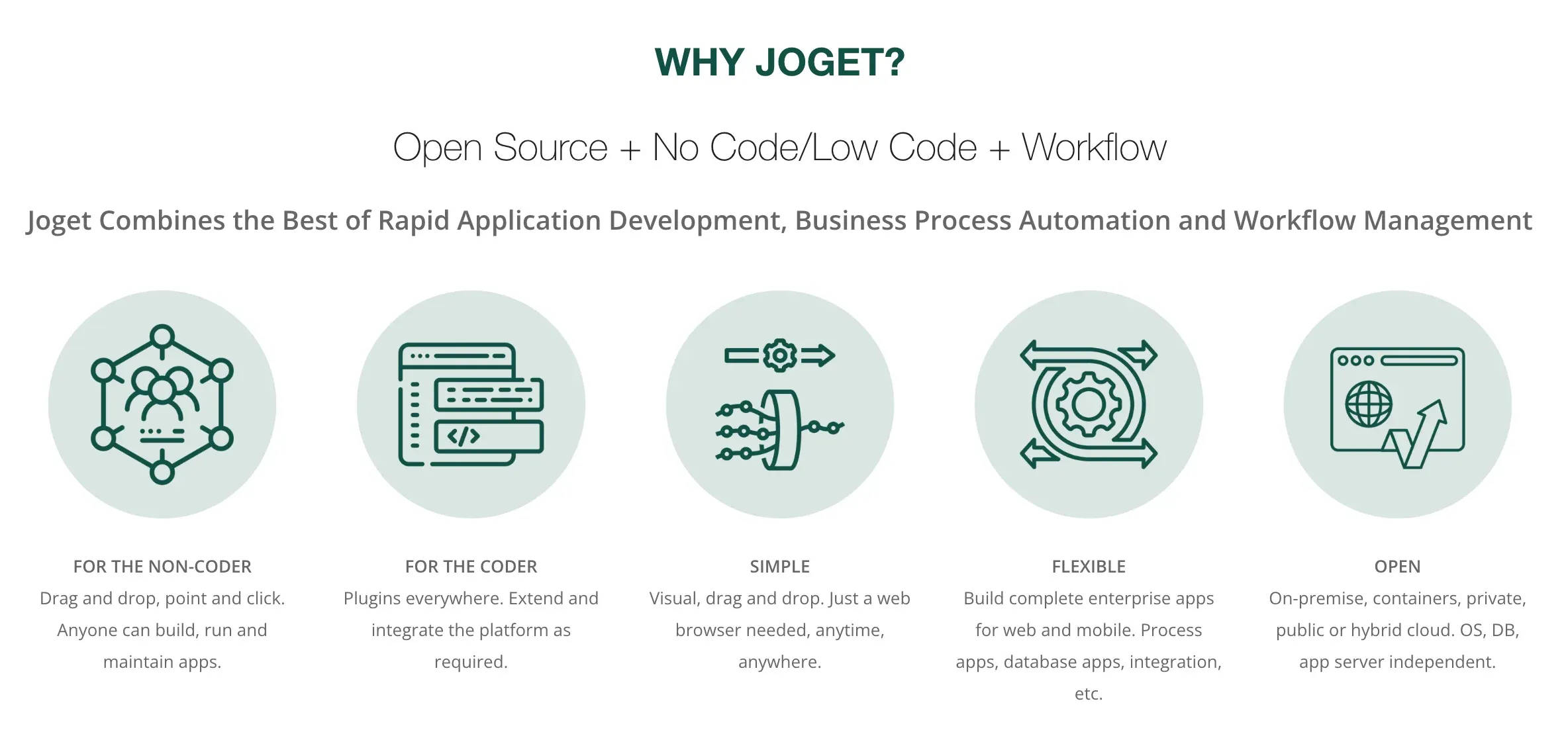

Joget is a no-code/low-code application platform that allows you to create apps without heavy coding. It’s designed to be user-friendly, so even those without a deep tech background can use it.

With Joget, you can build, test, and deploy applications quickly, making it ideal for industries that need fast, adaptable solutions.

Joget’s Low-Code Platform and Its Capabilities

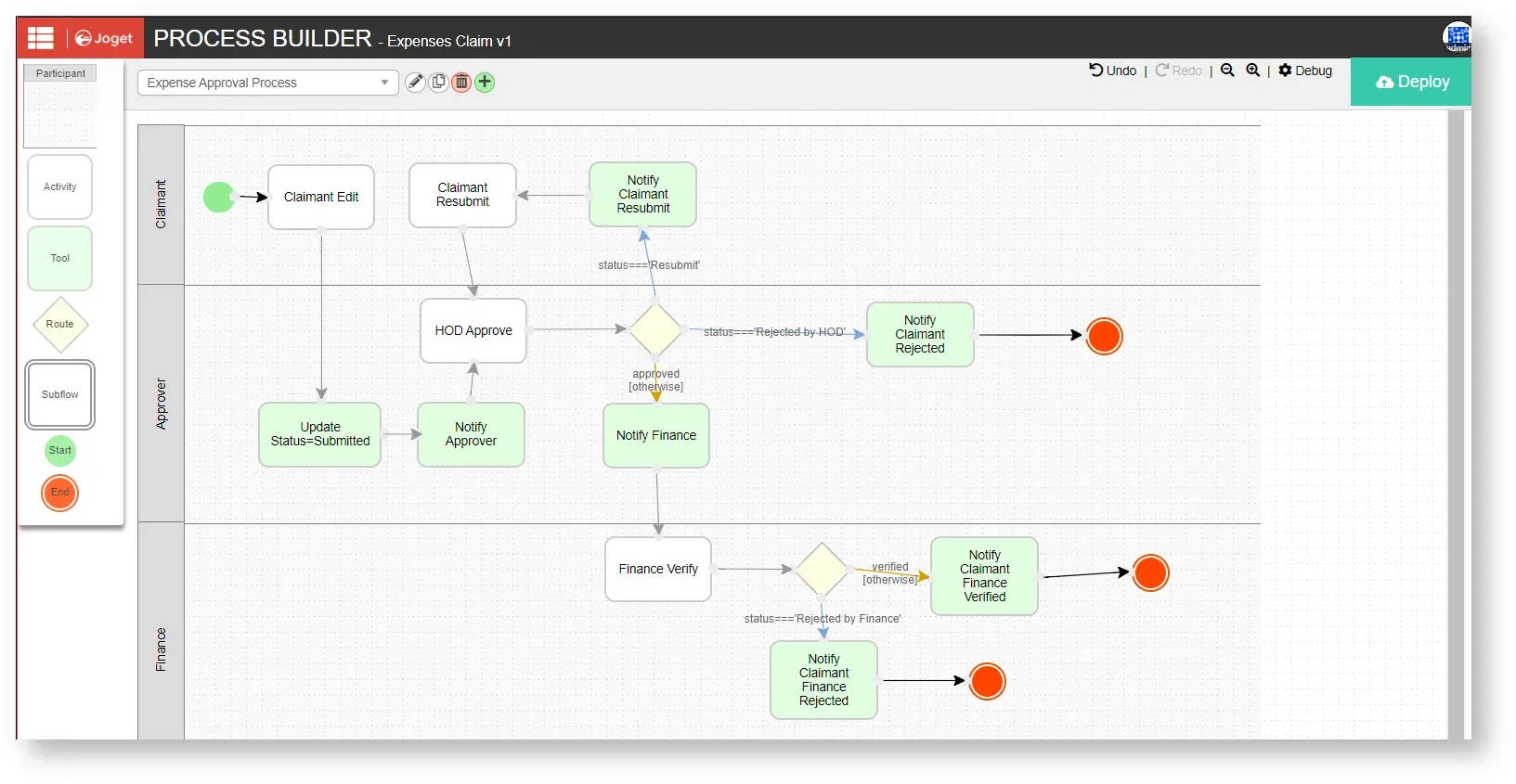

1) Drag-and-drop workflow management: Build processes and automate workflows with an intuitive drag-and-drop interface accessible to non-developers.

2) App generator: Quickly generate apps within minutes using pre-built templates or customize them according to your needs.

3) Dynamic plugin architecture: Extend and integrate Joget with external systems using a variety of plugins for enhanced functionality.

4) Cloud compatibility: Works seamlessly with various cloud platforms, application servers, databases, and operating systems.

5) Performance monitoring: Built-in tools allow for real-time monitoring and management of app performance, ensuring smooth operations.

6) Decision rules engine: Includes AI capabilities like TensorFlow integration to build smarter and more responsive applications.

7) Progressive Web Apps compliance: Automatically ensure apps are compliant with Progressive Web Apps (PWA) standards for mobile-friendly experiences.

8) DevOps integration: Supports DevOps practices with Git integration, enabling faster and more collaborative development cycles.

9) AI and IoT integration: Easily integrate AI and IoT devices into your applications for future-ready solutions.

10) Security and governance: Built-in security features, including user authentication and governance tools, ensure a secure development environment.

11) Joget Pricing: Free under GPL license with support. Upgrade for enterprise features and support!

You can visit their official website for more detailed information, including Joget pricing and tutorials.

Why Joget is Suitable for the Insurance Industry?

The insurance industry deals with complex processes, strict regulations, and the need for quick customer service. Joget fits perfectly here because it helps insurers automate repetitive tasks, ensure compliance, and respond to customer needs faster.

With Joget, insurance companies can stay competitive by being more agile and efficient, which is crucial in today’s fast-paced market.

Joget’s Role in Insurance

In the fast-paced world of insurance, efficiency is everything. Companies must make quick decisions, manage policies smoothly, and keep customers happy—all while staying compliant with regulations.

This is where Joget steps in. By automating key processes, Joget helps insurers stay ahead in a competitive market. Let’s explore how it plays a vital role in various aspects of the insurance industry.

Underwriting

Underwriting is a critical part of the insurance process, involving data collection and risk assessment. Joget automates these tasks, making them faster and more accurate.

With Joget, data from various sources can be collected and analyzed in one place, allowing quicker and more informed decision-making. This speeds up the underwriting process and improves the accuracy of risk assessments, reducing potential errors.

Policy Administration

Managing insurance policies involves creating, renewing, and updating them regularly. Joget simplifies this process by automating workflows.

Whether it’s generating new policies or handling renewals, Joget ensures that everything runs smoothly.

The platform also supports real-time updates, so any changes to a policy are instantly reflected. This automation reduces manual work, making policy administration more efficient and less prone to mistakes.

Streamlining Claims Processing

Claims processing can be time-consuming, but Joget makes it faster. Automating the entire process—from claim submission to payout—helps insurance companies handle claims more efficiently.

This speed reduces employee workload and improves customer satisfaction, as claims are processed more quickly and accurately.

Enhancing Customer Onboarding

First impressions matter, especially in insurance. Joget simplifies onboarding by automating tasks like data entry and document verification.

This not only saves time for the company but also smooths the customer's experience. Faster onboarding leads to higher customer satisfaction and retention.

Automating Compliance and Risk Management

Regulatory compliance is crucial in the insurance industry. Joget helps companies stay compliant by automating the tracking and management of regulatory requirements.

This reduces non-compliance risk, which can lead to costly fines and penalties. Additionally, Joget’s automation capabilities help identify and mitigate risks, further reducing costs associated with potential legal issues.

Case Studies: How Industry Leaders Use Joget

Joget is a platform that has proven to be a game-changer. It helps organizations automate workflows, streamline operations, and enhance customer experiences. Below, we explore how industry leaders have successfully used Joget in real-world scenarios.

1. Streamlining Claims Processing

A Fortune 100 global general insurance provider implemented Joget to automate its manual order approval process, which involved routing PDF documents for review and approval. The system addressed inefficiencies such as manual routing and physical document storage.

Solution: Joget’s platform utilized PDF reader plugins, intelligent validation, and automated routing based on business rules.

Approvers could authorize orders via automated email responses, reducing reliance on manual logins, enhancing speed, and increasing transparency.

Results: The solution reduced paper usage by 60%, processed data faster by 45%, and saved over $59K in man-hours, improving sustainability and freeing up resources.

2. Automating Compliance and Risk Management (Top 3 General Insurance Providers in India)

For one of India’s top general insurance providers, Eleviant Technologies built an Investigation Portal Management System to replace a paper-based claims investigation process. The system streamlined managing investigation tasks and reporting, integrating with legacy systems to improve turnaround times.

Solution: Joget’s platform enabled centralized management of investigations, including multi-level approval processes, dynamic mobile forms for field investigators, and automated claim data collection. Integration with existing ERP systems facilitated seamless data transfer.

Results: With 500 active users managing over 2,000 claims, the solution improved process efficiency by 75%, reducing the time needed to complete investigations and eliminating duplicated workflows.

3. Simplifying Claims Escalation in Insurance (Leading Insurance Provider in Thailand)

B Circle used the Joget platform to help a leading non-life insurance provider in Thailand modernize its internal memo approval process.

The company had relied on paper-based forms, which led to significant delays in approvals and high operational costs.

Solution: Joget’s dynamic workflow rules integrated memo approvals with digital signatures and Line OA notifications, significantly accelerating approval processes.

Automated updates reflected changes in the organizational structure, eliminating the need for manual workflow adjustments.

Results: The project resulted in an 80% reduction in memo-related expenses, with approval processes becoming 10 times faster. Urgent requests were processed within a day, significantly reducing administrative workloads(B-Circle-Mo-N-Flow).

4. Enhancing Customer Onboarding (Allied Benefit Systems, USA)

Allied Benefit Systems, a top third-party insurance administrator in the U.S., implemented Joget to digitize and automate its group health insurance client onboarding process, which had previously relied on spreadsheets and local databases.

Solution: Joget’s platform digitized onboarding processes, integrating business rules and workflows into a centralized record system.

The solution allowed business users to manage new products, services, and SLAs with audit tracking and configurable dashboards.

Results: Allied achieved a 50% productivity improvement and a 27% ROI, successfully onboarding over 2,000 groups in just six weeks. The solution reduced reliance on technical expertise and enabled full control of business activities.

Please review the case studies listed here for a more detailed Joget Tutorial on customer success stories.

Key Benefits of Using Joget in Insurance

In the insurance industry, where speed, accuracy, and customer satisfaction are key, Joget offers a platform tailored to insurers' needs. It helps automate operations, streamline processes, and enhance customer experiences.

Additionally, Joget Pricing is flexible, offering cost-effective solutions for insurance companies without sacrificing essential features.

Increased Efficiency

Joget automates policy management, claims processing, and customer onboarding through its intuitive workflow automation. Insurers can reduce manual work, allowing them to process more claims and policies in less time, increasing productivity and speed.\

Improved Customer Experience

Joget’s no-code platform allows insurance companies to create user-friendly applications tailored to customers.

By simplifying claims processing and policy renewals, insurers can deliver a smoother customer experience, leading to higher satisfaction.

Cost Savings

Joget minimizes development costs by reducing coding needs. Insurance firms can rapidly deploy custom applications, saving money on development while allowing quicker responses to market demands.

Scalability

Joget adapts effortlessly to business growth. Its scalability ensures that insurance companies can add new features, handle more users, and expand without requiring a full platform overhaul.

For more insights, check Joget pricing and Joget tutorials to explore how this platform can help your insurance operations.

Conclusion

We hope this Joget Tutorial has shown you how Joget is transforming the insurance industry by making processes faster, more efficient, and more customer-friendly.

Leading companies use it to streamline claims processing, improve customer onboarding, automate compliance, and manage policies effectively.

These real-world implementations show how Joget helps insurers stay competitive in a rapidly changing market. Adopting platforms like Joget will be crucial for staying ahead as the industry evolves.

By embracing this technology, insurers can improve their operations, enhance customer satisfaction, and meet future demands. Moreover, Joget Pricing offers flexible, scalable options that cater to varying needs, making it a cost-effective solution for businesses of all sizes.

Frequently Asked Questions (FAQs)

What is Joget and how does it benefit the insurance industry?

Joget is a no-code/low-code platform that helps insurance companies automate processes, streamline operations, and enhance customer service.

It improves efficiency, accuracy, and compliance, making it a valuable tool for modern insurers.

How does Joget improve claims processing in insurance?

Joget automates the entire claims process, reducing processing time, minimizing errors, and enhancing customer satisfaction.

By streamlining workflows, insurers can handle claims more efficiently and provide quicker customer resolutions.

Can Joget help with regulatory compliance in the insurance industry?

Yes, Joget automates compliance tasks by tracking regulatory requirements and managing documentation.

This reduces the risk of non-compliance, helping insurance companies avoid fines and stay up-to-date with ever-changing regulations.

How does Joget enhance customer onboarding in insurance?

Joget simplifies customer onboarding by automating data entry and document verification.

This speeds up the process, reduces errors, and improves the overall customer experience, leading to higher satisfaction and retention rates.

Is Joget suitable for small insurance companies?

Yes, Joget is suitable for insurance companies of all sizes. Its low-code platform allows even small insurers to automate processes, improve efficiency, and compete with larger players in the industry without significant investment in technology.

How does Joget integrate with existing insurance systems?

Joget seamlessly integrates with existing insurance systems like CRMs, billing platforms, and databases.

This integration ensures real-time updates, smooth operations, and a unified workflow, helping insurers manage their processes more effectively.

Table of Contents

- What is Joget?

- Joget’s Low-Code Platform and Its Capabilities

- Why Joget is Suitable for the Insurance Industry?

- Case Studies: How Industry Leaders Use Joget

- Key Benefits of Using Joget in Insurance

- Conclusion

- Frequently Asked Questions (FAQs)